Save over 1,300 euros per year? Try the 52 weeks strategy.

Need to save money in 2024 for a bigger margin in your monthly family budget or for a future project? There are several strategies you can use, like the 52-week challenge. Have you heard of it? Find out how it works next.

If you have credit and insurance, you can also try to review the contract conditions with the contracting entities. Contact Poupança no Minuto and, with the free help of a credit intermediary, find out which options are right for you. But first understand what the 52-week strategy is and how to apply it.

How to apply the 52-week savings strategy?

Want to start the year by putting some money aside, without noticing the impact on your wallet? The 52-week strategy is ideal for this goal: it helps you save a certain amount each week of the year, which increases and, annually, ends up becoming a significant amount. So, if you are looking to start saving for a future project, to pay off debts, or for more budget flexibility, take note of the procedure of this strategy.

This challenge entails little difficulty, which, however, increases throughout the months of the year. This is because the amount you set aside is increasing from week to week. It can be a good habit to gain to achieve financial discipline.

The strategy did not need to be strictly followed. As long as a portion of monthly income is set aside each week, from January to December, the challenge of the 52 weeks is met. This is the number of weeks in a year.

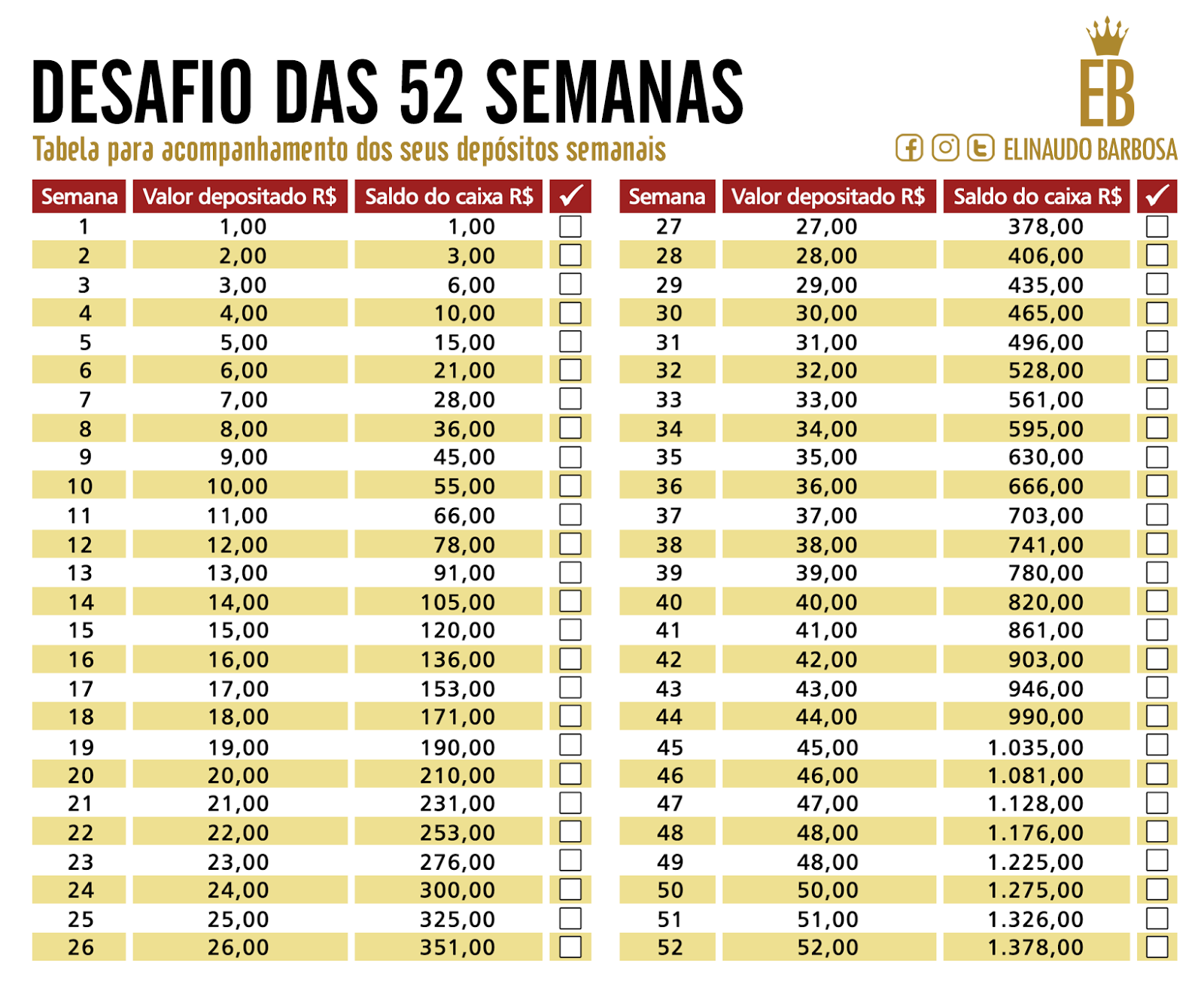

As a rule, you withdraw 1 euro in January, 2 euros in February, 3 euros in March, and so on. If you follow this challenge with this strategy, you end the year saving an exact accumulated amount of 1,378 euros.

If you notice, it's not a very complicated strategy to follow, because the maximum you have to set aside is 52 euros in the last week of the year. Therefore, it's not a challenging amount, but it allows you to save a significant amount by the end of a full year.

What challenges can I face?

The biggest challenge you may encounter is remembering to set aside the stipulated amount weekly for that period, which will require attention and dedication on your part. You can set a reminder on your phone so you don't forget. To make it easier, you can even add up the weekly amounts for the month and set aside monthly.

That is, in the first 4 weeks, the amount to set aside will be: 1st week - 1 euro, 2nd week - 2 euros, 3rd week - 3 euros, and 4th week - 4 euros, which will total 10 euros in the first month.

Another issue that may arise is where to put the saved money: it should be a safe place and more difficult to access, so as not to have the temptation to withdraw the money before the time. Some ideas may include, simply, putting it in a savings account or in another separate bank account, then you can invest by placing the amount in a retirement savings plan (PPR), or in savings certificates, or (in the old-fashioned way) withdraw the money and put it in a safe, piggy bank, or even under the mattress.

To find this saving and set it aside, you can choose to revisit credit and/or insurance contracts. Count on the free help of Savings in a Minute: we present proposals with more advantageous conditions than your current ones. Use and abuse our simulators and see how much you can save!